Biotechnology companies often need to raise capital to fund research and development of their pipeline. In a prior note (read here), we outlined what metrics are accurate predictors of an imminent financing announcement. Dilution, although not welcomed by existing investors, is sometimes a necessary evil. Financing rounds are the most common way for biotech companies to raise funds and keep the lights on. These offerings come in different forms, at times including dilutive instruments to help sweeten the financing round.

The following note will cover dilutive instruments commonly used by biotech companies, what to keep an eye on and questions to ask yourself when financing announcements are made.

What Are Considered Dilutive Securities?

1. Convertible Preferred Stock

Convertible preferred stock is a type of stock that can be converted into common stock at a predetermined price or at a specified time. This instrument provides investors with the potential for upside if the stock price increases, as they can convert, but also provides downside protection if the stock price declines by holding onto the preferred stock.

A recent example: Cidara’s March 2023 offering included 286,000 shares of Series X Convertible Preferred, which are initially convertible to 10 shares of common.

If a company has convertible preferred stock, you will be able to find it on the Stockholders’ equity section of the balance sheet. The terms and details of the convertible preferred stock will be found on the “Notes to Consolidated Financial Statements” section of the 10Q or 10K.

2. Warrants

A warrant is a security that gives the holder the right to buy stock at a predetermined price within a specified time frame. Warrants are often issued as a part of a larger financing round to sweeten the deal for investors. Warrants can be used to raise capital without immediately diluting existing shareholders.

A recent example: Checkpoint (CKPT) $7.5M financing in December 2022 included 2:1 warrant coverage, which means that for every share that was sold, 2 warrants were accompanying. In this case, the warrants were included as a sweetener. A common strategy for investors who participate in such deals is to sell the stock to recuperate the initial investment and hold the warrant for upside. The stock selling puts pressure on the shares and causes price declines. CKPT is down 25% since the deal.

3. Options

Options give the holder the right to buy or sell shares at a predetermined price within a specified time frame. Options can be granted to employees or used as a way to raise capital. Companies generally grant options to purchase common stock to employees.

4. Convertible Debt

Convertible debt is debt that can be converted into equity at a later date or under certain conditions. Convertible debt allows companies to raise money without immediately diluting existing shareholders. However, the conversion terms are important here. What is the conversion price? Is price adjustable downward?

If a company has convertible debt, you will be able to find it on the Liabilities section of the balance sheet. The terms and details of the convertible debt will be found on the “Notes to Consolidated Financial Statements” section of the 10Q or 10K.

What Is Ideal?

A “clean” capital structure, one in which a company has little dilutive securities, is preferred because there are no hidden dilutive instruments. To determine this, investors will need to dig through the latest SEC filing (10Q quarterly or 10K annual statement).

DETAILS MATTER: Look in the “Notes” part of the SEC filings to find details of each dilutive security. That is where you will find, among other details, how many dilutive securities are outstanding, what their expiration is and conversion prices. The devil is in the details, so much so that sometimes dilutive instruments “hide” the true valuation of the company, making it seem cheaper than it really is.

Valuation Basics: Shares Outstanding

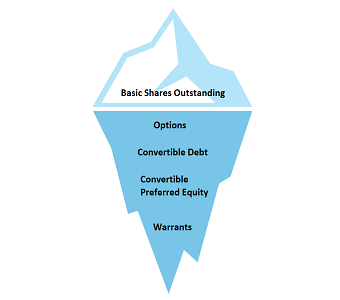

It's important to understand the difference between basic shares outstanding and fully diluted shares outstanding.

- Basic shares outstanding are the number of shares currently issued and outstanding.

- Fully diluted shares outstanding include all potential dilutive securities, such as options, warrants, and convertible debt. So, fully diluted shares outstanding = basic shares + dilutive securities

A company's market capitalization is calculated by multiplying the stock price by the number of outstanding shares. This number is the most common point of reference for valuing a company and can be significantly impacted by the difference between basic shares outstanding and fully diluted shares outstanding. When a company has dilutive securities, its “true” valuation is different from its “surface level” valuation. Think of an iceberg. At surface level, only the tip of the iceberg is visible, but in reality, the submerged iceberg is significantly larger under the water.

Take for example Avenue Therapeutics (AXTI):

Price (4/20/2023) = $1.03

Basic outstanding shares= 5.9M

Basic Market Cap = $6M

Dilutive securities: 4.49M

Fully Diluted Share Count (basic outstanding shares + dilutive securities) = 10.39M

Fully Diluted Market Cap = $10.7M

Why This Matters: Most finance websites (Yahoo Finance, Nasdaq, Bloomberg etc.) will only list the basic market cap. In ATXI’s case, that is $6M. But when taking into consideration all the dilutive securities, the market cap almost doubles to $10.7M.

When a financing is announced, keep these questions in mind as they will help determine if the deal was in high demand, or if terms include dilutive securities to stay away from.

- Was the financing “clean”, meaning just common shares were issued? If not, why couldn’t the company raise a round without needing to include sweeteners such as warrants?

- What is the exercise price of the warrants? Is exercise price much higher than the current stock price? When warrants are in the money (lower price than current market price), they lead to imminent dilution because they are often exercised.

- What are the terms of the preferred convertible equity? Is the conversion price fixed, or does it have downside protection?

- What are the terms of the convertible note? Is the conversion price fixed, or does it have downside protection?

Recap:

- Dilutive instruments are sometimes necessary to help sweeten or close a financing round. These instruments include warrants, options, convertible preferred equity and convertible debt.

- Dilutive instruments “hide” the true valuation of a company, making it seem cheaper than it really is.

- Don’t rely on the market capitalization figures that Yahoo Finance, Bloomberg and other financial websites show. Rather, go on the company’s most recent filing (10Q/10K) to determine the amount of fully diluted shares outstanding and terms of dilutive instruments.

Access This Content Now

Sign Up Now!