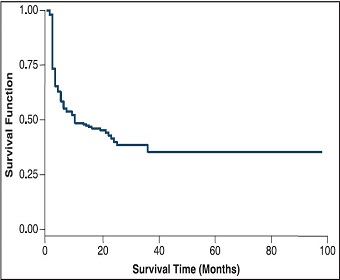

Bio investing is driven by near-term catalysts, rather than a buy & hold strategy. There is a 7.9% likelihood of FDA approval from Phase 1, so hoping that a small cap biotech will grow to become the next big pharma is highly improbable and not a sound investment strategy. Along the way to developing their pipelines, biotechs will announce several financing rounds and data readouts. To successfully navigate these events, biotech investors must understand the finer details of both.

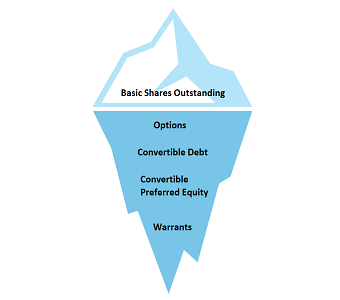

This note will cover what to look for in order to spot imminent financing risk. When a biotech company raises money, the share price will drop the majority of the time. This is because the company is diluting existing shareholders to bring in new capital to fund operations. Thus, in most cases, it is best to avoid names with imminent financing risk.

How Do You Know When Financing Risk is Looming?

Look for a Dwindling Run Rate

Generally, biotech companies will raise money when they need to, which makes predictability somewhat of a formula. A quick glance at the balance sheet and cash flow statement will show the current financial standing of a company and uncover this formula.

There are three definitions of importance:

- Cash: the cash balance to fund operations

- Burn rate: how much money the company spends each month on operations

- Run rate: how long the existing cash balance will fund ongoing operations. When this number falls under 12 months, financing risk is imminent.

The above metrics can be found on a company’s balance sheet and cash flow statement. Let’s look at an example.

Corbus Pharmaceuticals (CRBP) ended December 31, 2022 with total cash balance of $60M.

- This number comes from Corbus’ most recent statement, the 2022 10-K (found here)

- Cash balance includes: Cash and cash equivalents, investments and resrticted cash

Corbus spends 37M/year or approx. $3.1M/month

- This burn rate number comes from Corbus’ most recent cash flow statement by looking at “Net cash used in operating activities”

Given Corbus’ $60M cash balance as of December 2022, and $3.1M/month cash burn, the company has a run rate of 19 months. At this rate, Corbus would run out of cash by mid-2024. To have a buffer, financing efforts are ramped up prior to the company running out of cash. In Corbus’ case, financing risk would be something to watch starting mid-2023.

Recap:

Predict when a biotech company will raise money by looking at:

- Cash: the cash balance to fund operations. Found on balance sheet

- Burn rate: how much money the company spends each month on operations. Found on cash flow statement as “Net cash used in operating activities”.

- Run rate: how long the existing cash balance will fund ongoing operations. Cash divided by burn rate.

As a general rule of thumb, if:

Run rate less than 12 months: high financing risk

Run rate between 12-24 months: standard financing risk

Run rate greater than 24 months: low financing risk

Access This Content Now

Sign Up Now!