In my estimation, there have been approximately 114 PDUFA decisions relating to NDA/BLA and sNDA/sBLA’s in 2012. Of these, 97 applicants received drug approvals and 17 received complete response letters (CRL).

For this cohort of approvals, n=5 applicants submitted clinical data for studies that were completed pursuant to a SPA agreement. We’ve put together a case study of these five applicants, which offers thorough analysis of the process and outcomes.

Here is case summary for their regulatory reviews. For a full list of SPA trials, visit PropThink’s SPA Database; you’ll find detailed background information and a comprehensive list of ongoing and past trials conducted under an SPA.

Protalix BioTherapeutics & Pfizer: Taliglucerase Alfa for Type 1 Gaucher disease

Protalix (PLX) originally reached a SPA agreement for a pivotal study in 2007. This was a randomized double blind study comparing two doses of active therapy in N= 32 untreated patients with Gaucher disease. The primary end point was change from baseline in spleen volume measured by MRI at 9 months. Secondary outcome measures were changes from baseline in liver volume, hemoglobin and platelet counts. The company reported positive top-line results in October 2009, with the trial meeting its primary and secondary end points in both dose groups. Importantly, the primary end point was met at 6 months and maintained at 9 months. The drug received both Fast Track designation and Orphan Drug designation prior to the submission of the NDA in December of 2009. In February 2010, the company disclosed that the FDA had requested further information pertaining to the Chemistry, Manufacturing and Controls (CMC) section of the NDA and that no further clinical data was requested. In July, the NDA was formally accepted and a PDUFA goal of February 25, 2011 was set under standard review. On the PDUFA date, the company subsequently received a complete response letter citing unresolved questions. The main questions related to the CMC section of the NDA and the agency also requested additional data from switchover and long-term extension studies (which were immature at the time of original filing). A response to the CRL was submitted in August, 2011, which was accepted as a Class 2 resubmission, for 6-month review. Further select data presentations were requested by the agency, resulting in a 3-month extension to the review and a PDUFA goal of May 1, 2012. FDA approved ELELYSO(TM) (taliglucerase alfa) for injection as an enzyme replacement therapy for the long-term treatment of adults with a confirmed diagnosis of type 1 Gaucher disease on that date.

Vivus: Qsymia for Obesity

Like Protalix, Vivus (VVUS) successfully negotiated a SPA agreement for key elements of the pivotal Phase 3 clinical trials of Qsymia for the treatment of obesity and weight-related co-morbidities in 2007. The Phase 3 program would include two pivotal, double blind, placebo-controlled, multi-center studies in distinct populations (EQUIP and CONQUER) comparing Qsymia to placebo during a 56-week treatment period. The program would also include a six-month confirmatory factorial study, known as EQUATE in obese subjects with BMI’s from 30 to 45. This trial would evaluate two dose levels of Qsymia, compared to both placebo and the individual constituents of the combination. The co-primary endpoints for these studies would be to evaluate the differences between treatments in mean percent weight loss from baseline to the end of the treatment period, and the differences between treatments in the percentage of subjects achieving weight loss of 5% or more. All 3 trials were initiated in 2007. The company reported positive results from EQUATE in December 2008, and highly positive results from EQUIP and CONQUER in September 2009. These studies met all primary endpoints by demonstrating statistically significant weight loss with all three doses of Qsymia, as compared to placebo. Patients taking Qsymia also achieved significant improvements in cardiovascular and metabolic risk factors including blood pressure, lipid levels, and type 2 diabetes. The company submitted an NDA in December 2009 which was accepted for a standard review and PDUFA goal of October 28, 2010. The NDA was reviewed by an Endocrinologic and Metabolic Drugs Advisory Committee on July 15, 2010. However the Committee voted 10:6 against approval citing concerns with the adverse events observed with treatment, including depression, anxiety, sleep disorders, other cognitive disorders, metabolic acidosis, increased heart rate and an unclear potential for teratogenicity in both animals and humans. Subsequently a CRL was issued at the PDUFA goal date.

A number of meetings and communications took place between the sponsor and Agency between December 2010 and September 2011. A new route to resubmission was agreed upon seeking initial approval for an indication restricted to obese men and women of non-child bearing potential, until further retrospective studies could be completed to fully evaluate teratogenic risk. Vivus resubmitted the NDA with a proposed contraindication in women of childbearing potential in October 2011, which was accepted as a class 2 resubmission, 6 month review cycle and a PDUFA goal was set for April 17, 2012. The sponsor was notified that the resubmitted NDA would again be reviewed by an Advisory Committee. In January 2012, FDA requested that Vivus remove the Qsymia contraindication for women of childbearing potential contained in the proposed label. Qsymia would remain contraindicated for women who are pregnant. On February 22, 2012, the Endocrinologic and Metabolic Drugs Advisory Committee voted 20 to 2 in favor of approval for the drug contingent on an adequate Risk Evaluation and Mitigation Strategy (REMS) and with post-marketing safety studies. Finalization of the REMS program necessitated a 3-month extension for the PDUFA goal taking it to July 17, 2012. Qsymia was finally approved as an adjunct to a reduced-calorie diet and increased physical activity for chronic weight management in adult patients with an initial body mass index (BMI) of 30 or greater (obese), or 27 or greater (overweight) in the presence of at least one weight-related comorbidity, such as hypertension, type 2 diabetes mellitus or high cholesterol (dyslipidemia) on July 17, 2012.

Amarin: Vascepa for Very High Triglycerides

Amarin (AMRN) reached agreement with the FDA on a SPA for a pivotal registration study for Vascepa in 2009. The Phase 3 trial would be a multi-center, placebo-controlled, randomized, double-blind, 12-week study to evaluate the efficacy and safety of two doses of AMR101(Vascepa), a prescription grade Omega-3 fatty acid, in patients with fasting triglyceride levels of ≥500 mg/dL (the AMR101 MARINE Study). The primary endpoint in the trial was the percentage change in triglyceride level from baseline to week 12. Amarin also conducted a second Phase 3 study, titled ANCHOR, as a treatment for high triglycerides (≥200 and <500mg/dL) in 702 patients with mixed dyslipidemia (two or more lipid disorders) on background statin therapy at LDL-C goal who were at high risk of cardiovascular disease. In November 2010, the company reported highly positive results for MARINE with the primary end point being met for both the 4 gram and 2 gram dose groups. All secondary end points were also met and the drug demonstrated a positive safety profile. The company reported highly positive results for the ANCHOR study in April 2011. The primary endpoint for triglyceride change was achieved at both 4 grams and 2 grams per day with median placebo-adjusted reductions in triglyceride levels of 21.5% and 10.1% for the 4 grams and 2 grams per day dose groups, respectively. Moreover, for the 4 grams per day AMR101 group, LDL-C decreased significantly by 6.2% from baseline versus placebo, demonstrating superiority over placebo.

Amarin submitted an NDA on September 26, 2011, which was subsequently accepted for standard review with a PDUFA goal of July 26, 2012. On that date, the company announced that the FDA had approved Vascepa as an adjunct to diet to reduce triglyceride in adult patients with severe hypertriglyceridemia (TG greater than or equal to 500mg/dL).

Abraxis Biosciences/Celgene: Abraxane for Non-Small Cell Lung Cancer (NSCLC)

Abraxis reached a SPA agreement with the FDA on the design of a pivotal study for the use of Abraxane in the first-line treatment of NSCLC in 2007. The Phase III pivotal trial was a randomized, open-label trial comparing weekly 100 mg/m2 Abraxane (days 1, 8 and 15 of each cycle) and 200 mg/m2 paclitaxel every three weeks. Carboplatin would be administered at AUC=6 on day 1 of each cycle repeated every three weeks in both treatment arms. The study would enroll approximately 1,000 patients with Stage IIIb and IV non-small cell lung cancer. The primary endpoint of the study was overall response rate (ORR) and final positive study results were presented by Celgene (NASDAQ:CELG) at ASCO in June 2011 (Celgene purchased Abraxis in 2010). The study met its primary end point by significantly improving ORR for patients receiving Abraxane in combination with carboplatin. An sNDA was submitted for this indication in December 2011, and was accepted for standard review with a PDUFA date of October 12, 2012. On that date, FDA approved Abraxane for the first-line treatment of locally advanced or metastatic non-small cell lung cancer in combination with carboplatin for patients who are not candidates for curative surgery or radiation therapy.

Napo/Salix: Fulyzaq for HIV-Associated Diarrhea

Napo reached agreement with the FDA on the SPA process for Crofelemer in 2007. The ADVENT trial (Anti-Diarrhea therapy in HIV disease-Emerging treatmeNT concepts) was a randomized, double-blind, parallel-group, placebo-controlled, two-stage, adaptive design study to assess the efficacy and safety of crofelemer at 125mg, 250 mg and 500 mg oral doses twice daily for the treatment of HIV-Associated Diarrhea. The primary outcome measures were to determine the proportion of HIV-positive subjects experiencing relief of diarrhea with crofelemer compared to placebo during the placebo-controlled treatment Phase of 28 days, and to determine how many patients experienced two or less watery bowel movements per week during at least two weeks of the treatment Phase. Positive results for the ADVENT study were reported by Salix (SLXP) in November 2010, with the trial meeting its primary end points, forming the basis of an NDA submission in December 2011. The submission was granted a Priority review status and a PDUFA goal date of June 5, 2012. In April 2012, the company was notified by the Agency that additional review time would be required, prompting a 3-month extension to the PDUFA date, which was reset to September 5, 2012. On September 5, the company issued a release indicating that the NDA was still under review and that final action had not been taken by the Agency: “By taking no action at this time, the FDA has allowed for the currently ongoing dialogue between Salix and the FDA to continue…The primary topic is the production and control of the crofelemer active pharmaceutical ingredient, a complex mixture that is the first botanical product to be reviewed by the Agency for oral use. This focus is needed to ensure compliance with the manufacturing and product quality requirements of the Food, Drug & Cosmetic Act.” On December 31, 2012, FDA approved Fulyzaq as an anti-diarrheal indicated for the symptomatic relief of non-infectious diarrhea in adult patients with HIV/AIDS on anti-retroviral therapy.

I have documented 17 complete response letters received in 2012, and in all cases but 1, the FDA was seeking further clinical information or confirmatory studies prior to approval. Only 1 applicant receiving a CRL in 2012 had a SPA agreement in place, which is outlined below.

Ariad/Merck: Ridaforolimus for Advanced Soft Tissue Sarcoma

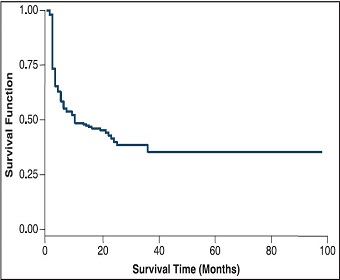

Ariad (ARIA) initially requested a SPA in March 2007 and finally reached agreement on a pivotal study design in August 2007. The Phase 3 randomized, placebo-controlled, double-blind SUCCEED (Sarcoma Multi-Center Clinical Evaluation of the Efficacy of Ridaforolimus) study examined the use of oral ridaforolimus as maintenance therapy in patients with metastatic soft-tissue or bone sarcomas who previously had a favorable response to chemotherapy. The primary end point was progression free survival (PFS) with overall survival (OS) and other measures of tumor response as secondary outcome measures. Importantly, in the agreed-to SPA protocol, the applicant estimated that the median time to PFS was 6-9 months and projected a 25% improvement in PFS. This translated into an increase in median PFS from 6 to 8 months or from 9 to 12 months with ridaforolimus. In communications to the sponsor, FDA stated: “Of note, PFS is not proven to be a surrogate for survival in this disease setting. A statistically significant difference in PFS may not necessarily represent a clinically meaningful difference. Whether PFS supports approval will be a review issue and would depend on the magnitude of the improvement and the risk/benefit ratio.” In January 2011, Ariad reported positive results from the SUCCEED study. However, on close examination of the results, ridaforolimus treatment resulted in a statistically significant 21% (3.1 week) improvement in median PFS (ridaforolimus, 17.7 weeks vs. placebo, 14.6 weeks). This was short of the 25% projected improvement in the SPA agreement, and the absolute magnitude of PFS benefit was only 3 weeks compared with the projected 2-3 month benefit assumption, with no significant improvement in overall survival. Nonetheless, Merck (MRK) submitted an NDA in August 2011, which was accepted for standard review in October, 2011. The NDA was reviewed by the Oncologic Drugs Advisory Committee on March 20, 2012, resulting in a vote of 13:1 against approval. The committee voiced concerns regarding the relative efficacy toxicity profile, citing the modest PFS benefit and high rate of treatment discontinuations and serious adverse events in the context of a maintenance therapy setting. On June 5, 2012, Merck received a CRL stating that additional clinical trial(s) would need to be conducted to further assess safety and efficacy.

The Takeaway

There are some key lessons that can be garnered from this analysis. First, sponsors who have successfully conducted studies that have met the predefined outcomes in a SPA agreement are highly unlikely to be rejected on the grounds that more clinical data/studies are required. In 2012, applicants with successful SPA studies forming the basis of a submission had a 100% approval rate (5/5). Unlike conventional sponsors, there is de minimis risk that they will be required to perform a further confirmatory study to gain approval. It is extremely important to understand the study design and underlying assumptions that have been agreed upon when determining if a study has, in fact, met the conditions for the SPA or not. Statistically significant does not always equal clinically meaningful.

Second, a successful SPA-backed NDA does not guarantee approval on the first regulatory review cycle. Companies submitting a clinical dossier with a SPA can still receive complete response letters. Just because a drug is efficacious does not mean that it is safe; the overall safety risk profile is the primary focus from a regulatory perspective and must be considered when evaluating positions.

Third, even the safest and most efficacious drugs can be held up if there are issues with the CMC component of the NDA. This aspect can be particularly challenging for novel biologic agents or drugs with non-oral routes of administration. It is extremely important to look into CMC hurdles when conducting due diligence.

Finally, the path from SPA to approval can typically take upwards of 5 years. Investors looking to initiate positions in a company holding a SPA agreement should consider holding stocks over an extended time horizon.