Shares of Vertex Pharmaceuticals (VRTX) are up 50% to $100 following success in two phase 3 studies of a cystic fibrosis drug combination that could be worth north of $3.5 billion annually. This is the biggest event in biotech this year, important because: 1) VRTX is large enough to move biotech indexes by itself; and 2) so many institutional investors were involved, one way or another, in the $14 billion company before today’s events.

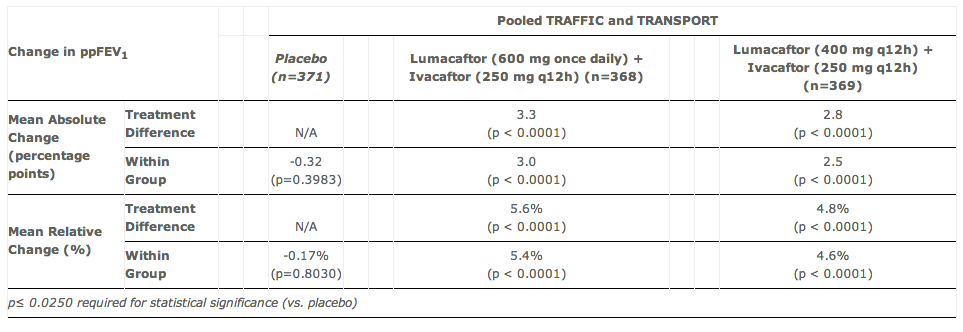

TRAFFIC and TRANSPORT, testing Lumacaftor (VX-809) + Kalydeco (ivacaftor) in patients with cystic fibrosis who have two copies (homozygous) of the F508del mutation, both met their primary endpoints. All of the treatment arms achieved the primary endpoint of mean absolute improvement in FEV1 compared to placebo, with a range of 2.6 to 4.0% (p≤0.0004) and a mean relative improvement of 4.3% to 6.7% (p≤0.0007).

In a pooled analysis of the two studies, the higher dose of lumacaftor (with Kalydeco) generated lung function improvement of 3.3% on an absolute basis when compared to placebo, and the combination regimen produced statistically significant reductions of 30-39% in the rate of pulmonary exacerbations (p≤0.0014).

This 3.3% absolute change is the figure to which Wall Street is paying close attention. Many on the Street were looking for a 5% absolute change as ultimate validation, though these results clearly have investors excited. At $150K per year (just shy of estimates for $160K) and some 22,000 patients in the major addressable markets globally, Vertex is looking at more than $3 billion annually. Kalydeco, by comparison, is priced at $300,000 annually and treats just a small fraction of CF patients.