Investor/entrepreneur Dr. Patrick Soon-Shiong is making a sizable investment in Sorrento Therapeutics (SRNE), in addition to forming a joint venture with the small company to develop immunotherapies for oncology and auto-immune diseases.

Dr. Soon-Shiong is a well-known name in healthcare for his role in inventing and developing Abraxane, an albumin-bound version of paclitaxel that was sold to Celgene (CELG) in 2010 for $3 billion, and is now one of Celgene’s lead oncology products, expected to do around $1.2 billion in 2015. Abraxane, as Sorrento puts it, is also the top competition for their lead drug candidate, Cynviloq.

Through a subsidiary of NantWorks, Dr. Soon-Shiong’s life-sci entity, the two are jointly forming “The Immunotherapy Antibody JV” as an independent biotech company with $20 million in funding.

More importantly for SRNE, one of Dr. Soon-Shiong’s entities will acquire a 19.9% equity stake in Sorrento via common stock priced at $5.80 per share (Friday’s closing price). Sorrento also granted the purchaser a 3-year warrant for 1,724,138 shares at $5.80 per share. The ~20% stake comes out to 7,188,061 shares, for an aggregate purchase price of $41,690,754.

This is what makes the investment more intriguing.

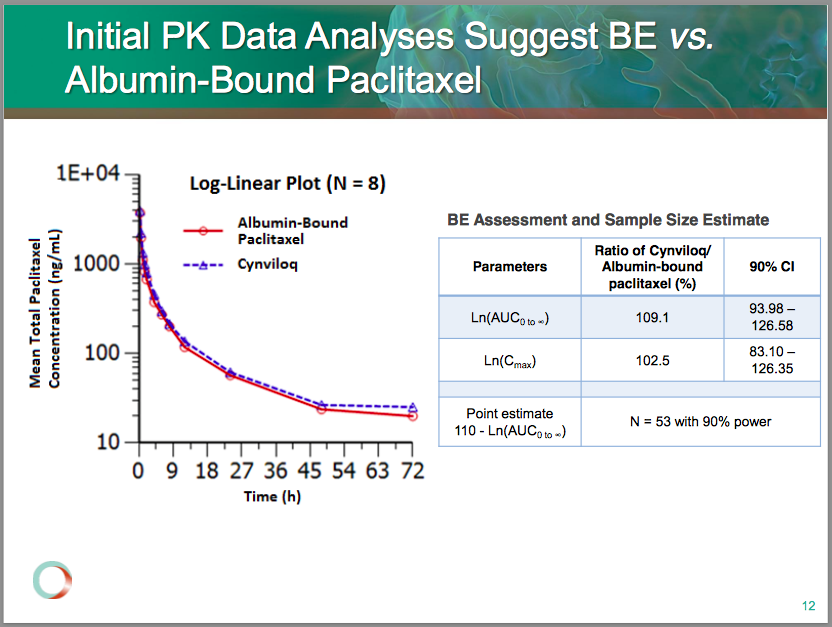

Sorrento’s lead product candidate is Cynviloq, a nanoparticle paclitaxel currently in a head-to-head trial versus Abraxane. Sorrento bills Cynviloq as a better alternative to Abraxane (“next-generation”) given the potential for higher paclitaxel dosing and fewer safety issues. The company is pursuing an approval through the 505b2 pathway, testing the drug’s bioequivalence (BE) to Abraxane (properties in the body), as opposed to large and lengthy phase 3 trials testing Cynviloq’s impact on cancer patients’ survival. Sorrento expects to have this (BE) data in the first quarter of 2015.

Sorrento took an early look at 8 patients from the TRIBECA study and has cut the planned enrollment from 100 to 54 based on data thus far. According to the company, the FDA may be open to this small population, though this is still the 2nd biggest risk to SRNE (2nd to a failure in the BE study) – the FDA demanding a full-blown phase 3 program.

Is Dr. Soon-Shiong endorsing the potential of Cynviloq, or simply hedging a position in CELG? Either way, with SRNE’s recent breakout and data in the next three months, the idea of a long position is still attractive.

Updated to include size of purchase.