In one of the most shocking accounting errors we’ve seen in pharma, Salix Pharmaceuticals (SLXP) reported on Thursday after the bell that it has nine months of inventory for some of its most successful gastrointestinal products backed up in distribution networks. This is “channel stuffing” at its extreme, though the company is adamant that this is a result of accounting errors, not an intentional occurrence. Salix trimmed its full-year guidance as a result, and its stock has cratered in the aftermath as investors struggle to understand what went so wrong and exactly how to value the company moving forward.

The company’s Board of Directors has retained outside counsel and is conducting a review of management’s characterizations of wholesaler inventory levels in the past, and alongside its third quarter earnings and conference call the company announced that Chief Financial Officer Adam C. Derbyshire has resigned. On Thursday’s call, management was adamant that the company’s accounting “in relation to sales to wholesalers” has been appropriate, pointing out that independent auditor Ernst & Young stands by its reviews for the last three quarters.

Our view: these kinds of accounting discrepancies often go much deeper as digging continues, and the adage “where there’s one roach, there’s usually a whole lot more” seems appropriate.

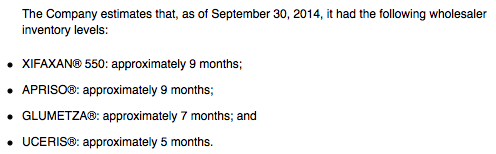

Salix’s future revenue is in question because the company now has to work through some 6+ months of stockpiled inventory at the wholesale level for key products, like the diarrhea drug Xifaxin and the ulcerative colitis drug, Apriso:

Normally, pharmaceutical companies keep in the range of 8-12 weeks of drug product in the distribution channel (depending on shelf-life and demand), which is why the 5-9 months for some of Salix’s products is so jarring. It’s not entirely clear how the company has been accounting for these sales and how it will affect forward revenue until the backlog can be worked through, which the company says could take two years.

Salix lost almost $3 billion in market value with the news.

Salix’s third quarter conference call is worth a listen for a better idea of just how little is understood about the issues at hand.