-TKMR remains an interest at PropThink despite rising 260% since coverage in January. Stock is undervalued relative to peers, has an expanding pipeline, and is recently capitalized, now trading below offering price of $28.50.

-We see little reason for investor interest in RNAi to abate, barring major macro shifts. 20-day SMA around $23.88 provided support on Tuesday.

In a market hungry for exposure to gene therapy developers, Tekmira Pharmaceuticals (TKMR) raised more than $60 million last week in a secondary stock offering that extends the company’s cash runway beyond 2016 and fills the company’s warchest to make some strategic maneuvers. This is the second financing from Tekmira in 6 months.

Tekmira sold 2,125,000 shares at $28.50 for gross proceeds of $60.6 million. The deal should net around $65 million including the underwriter’s over-allotment and increases the company’s outstanding sharecount to 22.2 million. The company ended 2013 with $68.7 in cash & equivalents and added$14.5 million in January through a licensing deal with Monsanto (MON). The company should end this quarter with roughly $140 million, meaning TKMR’s enterprise value stands at just over $450 million.

Frankly, we’re not sure what’s going to stop TKMR from continuing the uptrend (higher highs and higher lows). Investors still view Tekmira as cheaper way to be involved in RNAi, particularly as the company expands its clinical-stage pipeline and demonstrates more evidence that LNP has broad applicability (now compelling results in mRNA delivery). In the past, we (and every other bullish TKMR pundit) have compared Tekmira to Arrowhead Research (ARWR), which carries an enterprise value of around $800 million. Given the “platform” nature of Tekmira’s business, peer comparison remains the appropriate valuation approach.

We believe that TKMR surpassing its 52-week highs at $31.48 is a likely near-term reality. The stock bounced from key support on Tuesday, a trend across the sector following a brief downturn for healthcare equities last week.

Of course, biotech investors are keen to know where the next “catalyst” for Tekmira lies. A dose-escalation safety and PK study of TKM-Ebola is underway and should read out in the second half assuming the company reaches maximum tolerated dose under current trial protocol (expanded once already). Recall that this program falls under the FDA’s Animal Rule, which allows for proof of safety in humans and proof of concept in animals due to the danger inherent in infecting humans with the Ebola Virus. The program received Fast Track designation from the FDA in March and is funded by the U.S. DoD.

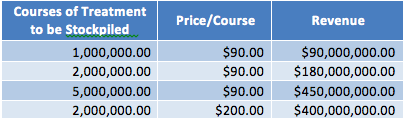

Of note, Tekmira said on its YE conference call that the government has expressed interest in allowing a provisional approval in order to begin stockpiling the product. Essentially, Tekmira could be generating revenue as early as 2016. (As an aside, read our recent research on Emergent Biosolutions (EBS), which profits from US biodefense stockpiling programs, and we believe is a Buy.) Food for thought: similar biodefense stockpiling arrangements with the CDC’s Strategic National Stockpile (SNS) have called for between 2 million courses of treatment (SIGA Technologies’ (SIGA) smallpox antiviral Arestvyr) and around 14 million courses (70 million doses of BioThrax at 3-5 doses/course). On the pricing spectrum, Arestvyr runs $200/course and BioThrax around $30/dose, $90 for an initial course. Tekmira has speculated in the past that at the midpoint of the government-supplier contracts -Ebola could fetch $2400 (the company also suggests that volume would be 45K per year). Below we summarize how this spectrum might play out for Tekmira and the Ebola candidate, if approved, using the low end of the pricing spectrum.

Although we’re speculating, Tekmira stands to realize meaningful revenue from the Ebola program – the company has in the past suggested $100M annually. Note that Emergent’s biggest hurdle has been manufacturing capacity.

Tekmira will also finalize candidate selection for its HBV program and present pre-clinical results, with plans for an IND filing, in the second half of the year. With a 30-day turnaround on the IND, the company may have TKM-HBV in the clinic by the end of the year. That doesn’t put TKMR prodigiously behind ARWR, which is just now taking its own HBV candidate, ARC-520, into a phase 2a Proof of Concept study. ARWR will have evidence of human efficacy for -520 in 3Q14.

In addition, Tekmira will have data from a phase 1/2 trial of TKM-PLK1 early in the second half and will begin a trial in hepatocellular carcinoma (HCC) in the first half of the year. The ongoing trial tests –PLK1 in patients with refractory GI-neuroendocrine tumors (GI-NET) or adrenocortical carcinoma (ACC) tumors. We note that the company does not plan to stratify patients on PLK1 expression in the HCC trial, and did not in the G-NET/ACC trial. We have low expectations for the PLK1 program, but this seems to be the case with most investors we’ve spoken with, suggesting that TKMR’s valuation is built on more than this pipeline candidate.

In connection with TKMR, PropThink has taken a long position.