The most quoted piece of information from analyst reports also happens to be the most useless. Price targets should be taken with a grain of sale, and should definitely not be used as a measure of upside in the covered company. Unfortunately, many investors will rely on an analyst price target to make an investment decision, causing huge swings in the price of small-mid cap healthcare companies.

To understand the conflicts of interest with a research report, we first need to understand how financial services firms and investment banks (ie. Goldman Sachs, Oppenheimer, Wedbush etc.) make money.

Investment Banking & Brokerage Divisions Are Money Makers. Research Coverage is an Added Perk

Most financial services firms will not charge a publicly traded company for their research coverage. Therefore, the research division of a firm does not generate any direct revenues.

Not receiving compensation specifically for research coverage does not mean reports are unbiased

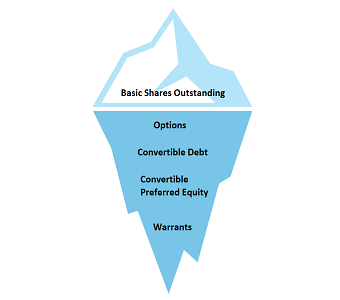

Instead, a publicly traded company (Celsion Corp: CLSN, for example) will engage a financial services firm (Oppenheimer, for example) to help raise money. Oppenheimer will raise Celsion money and in turn be compensated handsomely for these investment banking services.

Now, Oppenheimer’s investment advisors have their clients’ money invested Celsion. These advisors generate profits for Oppenheimer through commission and asset management fees. The better Celsion stock performs, the better these investment advisors look to their clients.

Profits from investment banking & brokerage division are used to pay the salaries of analysts in the equity research department

The research analysts may now be pressured by the investment banking and brokerage divisions to provide more optimistic recommendations and higher price targets. After all, these two divisions are the money makers and it would be in everyone’s best interest if CLSN was trading at a higher share price.

Although the publicly traded company may not directly be paying the analyst for a “BUY” recommendation, it is paying the analyst’s firm for other services that in turn pay for the salary of the analyst. In other words, sell-side analyst reports are not as unbiased as many investors think

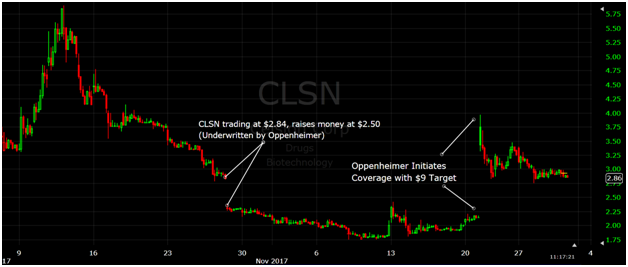

Example of Celsion & Oppenheimer Prove This

Research coverage generally comes as an added perk for investment banking clients of the analyst’s firm. Here’s a timeline of this whole phenomenon at work.

October 27, 2017: Celsion announces underwritten offering of 2.64M shares at a price of $2.50/share (CLSN market price is $2.80). Oppenheimer is the underwriter of the offering.

Late October – Mid November 2017: CLSN shares trade in the $2.00 range

November 20, 2017: Oppenheimer initiates research coverage of Celsion with a $9.00 price target. Shares jump to $4/share.

As seen above, the research report, which caused CLSN price to jump more than 75% was not as unbiased as investors may believe. Promise of favorable research can be an important component of the marketing of investment banking services.

This investment banking & research relationship happens frequently in the banking world. Investors should be aware and use research reports solely for due diligence. Always read disclosure sections at the end of analyst reports and pay little attention to price targets.