- Albany Molecular recently began talking up an aggressive growth plan to increase revenues more than 5-fold to $1.35 billion by 2019.

- Management has a proven track record of value creation and execution, suggesting this goal may be realistic coming from this team.

- While a long position in this environment may be premature, AMRI is a name worth adding to any healthcare investor’s growing shopping list.

An aggressive growth plan laid out in early 2014 by management has us interested in Albany Molecular Research (AMRI). With a goal to roll up small, private companies in the pharmaceutical industry, Albany Molecular has already begun executing with what we believe is a tenured, well-respected team led by relative newcomer CEO, William Marth. PropThink has been following the Albany Molecular story in 2014, waiting on a pull back to initiate a fundamentals-driven position. We’re paying even closer attention as the valuation has declined >20% since mid-March. Shares are undoubtedly subject to the market phenomenon of “sell anything with a growth multiple”, but multi-bagger potential and increasing exposure to the company’s growth plan could mitigate near-term uncertainty. Regardless, we remain cautiously optimistic as the stock finds support in the $15 range – it’s certainly a story worth knowing.

Albany Molecular is taking on a new and diversified form. Under the leadership of Co-Founder and President Thomas D’Ambra, Albany Molecular was previously beholden to royalty streams generated as an outsourced Contract Research Organization (CRO). The company is best known for discovering the process to synthesize terfenadine carboxylic acid (TAM) in a purer form. TAM is the Active Pharmaceutical Ingredients (API) in fexofenadine (Allegra), and the company has received $551m in aggregate royalty payments over the life of a licensing agreement signed with Sanofi Aventis (SNY) in 1995.

Albany Molecular began deemphasizing a portion of internal R&D operations in 2010 to become profitable independent of Allegra royalties by focusing on higher margin drug discovery programs while building out a broader portfolio providing branded API; contract manufacturing, such as fill/finish services; and providing CRO services. Albany Molecular is now profitable and partners its capabilities with many leading branded and generic drug developers including Actavis (ACT), Genentech (RHHBY), Teva (TEVA), Bristol Myers (BMY), Eli Lilly (LLY), Merck (MRK), and Shire (SHPG). The company generated revenues of $247m in 2013, which has grown at a modest 6% CAGR since 2009.

What makes this story interesting? Bill Marth has been on the road this year with an aggressive plan to reach $1.35 billion in revenue within five years, an increase of nearly 6x that should take shares along with it. We reference Endo Health Solutions (ENDP), a spec pharma story in which investors gave new management, led by former Valeant (VRX) COO Rajiv Desilva, significant credit in advance of a similarly aggressive growth strategy in 2013 – the stock has since tripled in value. Although AMRI isn’t the “value” name that ENDP was in early 2013, it is a management-driven thesis. You can read PropThink’s early coverage of this acquisition/divestiture story, here.

Investors will welcome acquisition-related newsflow in 2014 as this management team attempts to grow AMRI beyond its small-cap roots. The sell-side is slowly catching on, and forthcoming initiations should drive continued interest in the company.

Through 2019, Expect Acquisitions

The run up in AMRI shares on March 12th corresponds directly with management’s presentation at the Barclays Global Healthcare Conference, where Mr. Marth laid out an aggressive growth-through-acquisitions plan, targeting $1.35 billion in revenues by 2019. Recall that the company did $247m in the trailing twelve months.

Albany Molecular plans to roll up 2-3 branded, high-margin businesses annually for $20m-$60m per transaction. The CRO industry is highly fragmented, with numerous small companies in addition to a few scaled generic providers eyeing mostly low-margin, larger foreign firms for acquisition. Folding in these small players is not an unrealistic task. For an example of a successful and similar strategy, we look to Stericycle (SRCL), which consolidated the medical waste industry by acquiring regional competition, mostly small private medical waste companies, delivering shareholders a 413% return since 2005.

Albany Molecular will use cash for its first few transactions (currently $176m in cash on the books) and lever up to 4.0x EBITDA (3.3x TTM EBITDA) for transactions that are immediately accretive. The acquisition of Cedarburg Pharmaceuticals in March is a quality example of the buyout criteria Albany Molecular is seeking: the company paid $38.2m in cash for a private, high-margin (25% EBITDA margin, vs. 15% for Albany Molecular) API provider in the controlled substances space that Albany expects to add $0.06-$0.07 in EPS for 2014. Albany Molecular is seeking similar opportunities to build out its API portfolio in controlled substances, in addition to protein peptides, cytotoxics, hormones, steroids and complex molecules.

$1.35B will not be attainable by inorganic growth alone. Albany Molecular is building out its core drug discovery, API, and contract fill/finish businesses. Notably, the company is expanding its drug discovery presence through a partnership with the state of New York. Albany Molecular is the anchor medical tenant for a $1B economic development initiative aimed at medical and technology-based firms, and the company leases a full cycle drug discovery space/equipment for $1 – yes, $1. This strategy not only allows Albany Molecular to relocate its high fixed-cost operating facilities to improve margins, but also aligns with its strategy to enter into biologics discovery, an area that provides exposure to drug developers with expansive monoclonal antibody, cytokine, therapeutic vaccine and cancer killing therapies in their pipelines.

We view these related discovery and API targets as an extremely attractive market reasons beyond being highly sought after by developers. These are high-margin, value-creating businesses with potential for greater-than high-teens ROIC. Bio-Techne Corp. (TECH), for example, is a leader in cytokine drug discovery/API and generates a 53% EBITDA margin (recall 15% for Albany Molecular) and a ROIC of 15.8% (4.0% for Albany Molecular).

Management is Key

Talking up a growth plan is easy. Delivering results isn’t. An AMRI position early in the game is clearly a call on management and its ability to execute. We suspect the company has the right folks in place to deliver.

Quarterbacking is William Marth, former CEO of Teva Pharmaceuticals’ largest operating segment, Teva USA, which he led from 2005-2012 and served in senior business development roles since ‘99. He was an instrumental architect in TEVA’s strategy to fold in the generic space towards the number one producer of off-patent drugs. A lesser-known fact was that Teva built an in-house API business that grew revenues by over three-fold from 2000-2012. Marth played an important role in this growth, as did George Svokos, who joined Albany Molecular this January after a 30-year career at Teva. Svokos will lead the company’s API operations along with Vijay Kumar Batra, another Teva alum , who will direct the company’s API operations in India, as he did at Teva. While Albany Molecular’s success will ultimately be a function of contributions from various parties, we can’t underscore enough the importance of having qualified leadership at the helm.

Albany Molecular’s team is impressive on paper, but it’s results – execution and capital allocation flowing through to financial performance – that drive value for shareholders. ROIC and growth in Book Value Per Share (BVPS) are relevant metrics to gauge management’s potential. From 2005-2012, Teva’s consolidated business achieved an average ROIC of 7.5%, far higher than generic competitors Mylan, Actavis and Perrigo at 3.2%, 1.5% and 3.7%, respectively. BVPS also grew at an impressive 15% CAGR during the same period. Knowing Albany Molecular’s new leaders, who were in key positions at Teva during this growth period and know the industry, we have faith that the team can acquire smartly and execute.

What if Management Does Indeed Achieve its Goal?

First off, we believe there’s a high probability this team can deliver growth, and leadership has set a high bar. AMRI is a 4-5 bagger if management can reach its target of $1.35B in revenue through 2019. Given the imprecision in predicting financials from an open-ended growth strategy, we prefer a simple back-of-the-envelope valuation: at 2x sales AMRI would be a $2.7B company. Currently, $550 million.

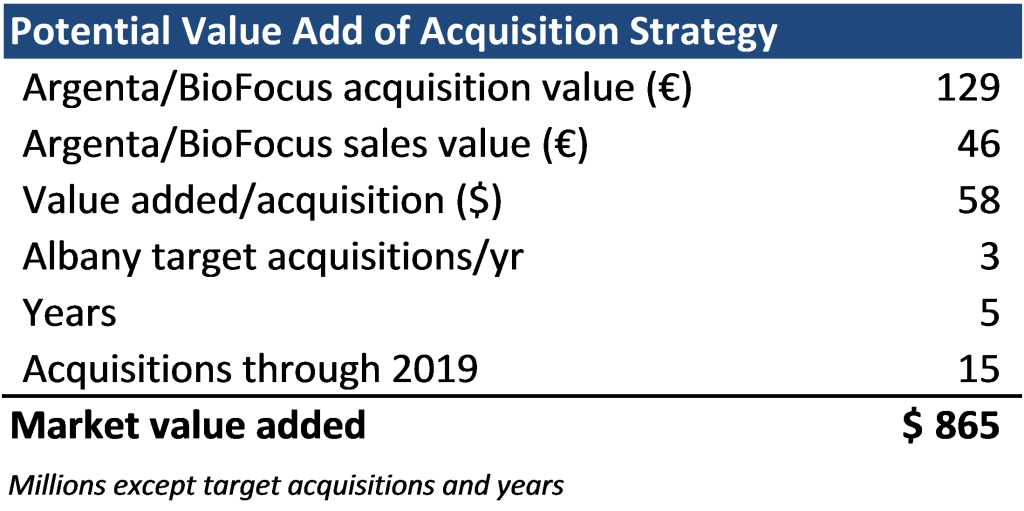

Growth by acquisition is a viable strategy. In the CRO space, Galapagos NVs’ Argenta and BioFocus subsidiaries were recently sold to Charles River Laboratories (CRL) for €129m; Galapagos purchased the firms originally for €46m. The average value added by these transactions was €41.5m, or $57.5m. Albany Molecular is targeting similar $20-$60m buyouts for high-margin, pharma outsourcing businesses. In fact, Argenta and BioFocus would fit the AMRI strategy quite well.

Extrapolating from these Galapagos results, and in line with Albany Molecular’s goal to acquire three companies annually, modest inorganic growth alone could contribute $865m in value through 2019. This is significant given AMRI’s $509 million valuation today. Add in continued growth from existing programs, and the potential to reach a valuation approaching $2.7B is far more feasible. If management does deliver on its plan, buying now implies that investors are purchasing the core existing operations, with growth, for free.

The company’s strategy is in the public domain, resulting in a high P/E multiple (41x) that certainly exposes the share price to some downside in the event that the sector remains under pressure. For those more concerned with short term swings, shares have recently found support around $15, the price at which the stock traded prior to Marth’s first presentation outlining publicly the company’s aggressive plan.

As the company executes, we suspect newsflow surrounding acquisitions will be welcomed by shareholders and bring a greater investor community around to the Albany Molecular story. Furthermore, we note that this remains an under-followed story, in-part because it lacks sex appeal (API? CRO?). Morgan Stanley recently initiated coverage, following a late-2013 debt deal, and co-manager of the same deal, J.P. Morgan Securities, initiating coverage in the interim will serve to improve the equity’s visibility. Future debt issuances, accompanied by a higher market cap, may bring other sell-side firms around on the story as well.

PropThink and/or its contributors have taken a long position in AMRI.